In Our DemocracyTM, ScienceTM and our “leaders” aren’t doing a very good job

Derivatives and the Banking System

With the failure and bailout of SVB Bank and Signature Bank, the FDIC insurance fund, which is supposed to bail out banks when they fail, is bankrupt. This banking insurance fund only had $100 billion or so before the collapse of SVB and Signature. SVB had about $150 billion in unsecured deposits, and Signature had about $50 billion. The rest of the bailout money was printed by the Fed. If another regional bank (perhaps your bank) collapses due to rising interest rates and falling bond prices, where will the “money” come from to bail it out? Sorry folks, there aint no money left. The elite venture capitalists already got theirs, and bankrupted the system. Mr. Potter doesn’t have any money left for the hard working taxpayers.

First Republic Bank is also on shaky ground. On Thursday 11 major US banks pledged to deposit $30 billion into it. This does not bode well for our banking system.

Our elites are destroying the economy and swooping up the assets and the remaining wealth of this country, causing bank runs on their own banks, and sending over $100 billion for a proxy war in Ukraine against Russia. The War in Ukraine has morphed from defending the Ukrainian people into a sophisticated money laundering operation, while the people are lied to by our so-called “leaders.” The corruption in both banking and government is becoming more and more visible to the public.

As shaky as the system is now, there’s an even bigger problem. No one talks about derivatives, the elephant in the room. Derivatives are financial contracts set between two or more parties that derive their value from an underlying asset or group of assets, such as a group of mortgages, stocks, bonds, or commodities. The problem is that although derivatives can be used to reduce risk (hedging), they are far more likely to be used to speculate on the price movement of an underlying asset, or to leverage holdings. A leveraged financial instrument can be purchased with only a small amount of capital and gives you an interest in a much larger amount of value in the underlying asset. So you can invest, with just a little cash, in a very large number of markets and financial instruments. In the process, of course, you spread you money very, very thin.

As more and more derivatives – such as collateralized mortgage obligations, which are tranches or slices of a pool of mortgages – are created on top of the original pool of mortgages, they become more and more detached from the real asset. Investment banks have been creating derivatives for decades as a way to make money. But many of these derivative contracts cannot even be valued – they cannot be “marked to market.” That is because many of these financial instruments are so far removed from the real asset that they are essentially valueless.

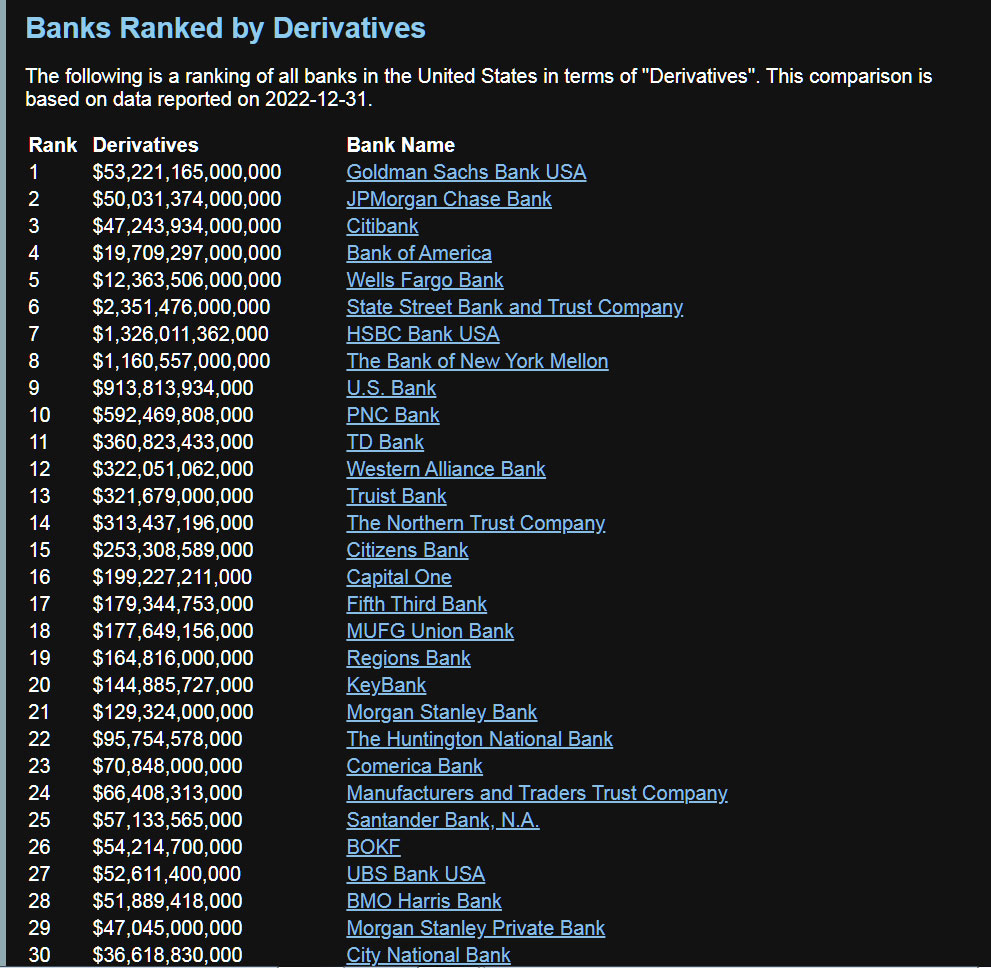

Ok, so no big deal, right? Our Tresury Secretary, Janet Yellen, tells us that the banking system is “sound.” Not being one to trust politicians, out of curiosity I looked up the exposure of U.S. banks to derivatives. I couldn’t believe what I found. This is a screenshot of partial list of banks.

Source: https://www.usbanklocations.com/bank-rank/derivatives.html

Check out the first three investment banks – three of 20 Big Banks (banks that are “too big to fail”) that handle U.S. Treasury auctions and which collect substantial fees for doing so.

Leading the pack is Goldman Sachs, with over $53 trillion in derivatives. Uh, excuse me. $50 TRILLION? How the hell can a bank have that much exposure on their books?

It comes from greed and unbridled speculation. Note that the values listed here are par values. Meaning that this is what the banks themselves determine is their worth. The real value of many of these derivatives aren’t even close to the par value, but the banks can’t admit that or they will all collapse. Neither can the bank regulators. Oops! Also note that this isn’t new information. A banker would yawn at this essay. It’s common knowledge at the Fed, and the government oversight committees in Congress, at the FDIC and the SEC.

The next two banks all have around $50 trillion in derivatives on their books. If you go to this website and add up these figures, you get an astonishing total of about $193 trillion dollars in derivatives on the books of U.S. banks (that was my quick calculation).

And we wonder why banks are in trouble?

Go to the website and check the list to see where your bank stands. The list is longer than the image here.

The graph above just lists the derivatives held by banks in the US. According to Investopedia,

The derivatives market is, in a word, gigantic—often estimated at over $1 quadrillion on the high end. How can that be? Largely because there are numerous derivatives in existence, available on virtually every possible type of investment asset, including equities, commodities, bonds, and currency. Some market analysts even place the size of the market at more than 10 times that of the total world gross domestic product (GDP).”

https://www.investopedia.com/terms/d/derivative.asp

Wow.

Again, the values in this table are the dollar amounts that the banks assign to the worth of their derivatives. This is called the notional value, or face value.

“Notional value is a term used to value the underlying asset in a derivatives trade. The notional, or face, value of derivatives contracts is much higher than the market value due to the use of leverage, or borrowed money.”

The derivative game is played by investment banks assigning dollar values to their own portfolios. The derivatives market, worldwide, is a gigantic albatross around the neck of the world’s financial system.

It’s a nice gig, isn’t it? Hey, why don’t you get a printing press and start printing money in your basement? That’s what the derivatives market essentially does. If you or I were to do this we would be – rightly – thrown in jail.

Investment banks have the ability to literally create financial instruments that are backed by nothing, just like the fiat money currencies such as the dollar and the euro.

So the next time you hear rich guys – like the venture capitalists in SVC Bank, whose investors started a run on their own bank – cry about bailouts, take it with a grain of salt. The gummint bailed out the rich depositors in SVC Bank and Signature Bank, and bankrupted the FDIC’s bank insurance fund.

In my opinion, the banking system must be reset to wipe out all so-called “assets” that cannot be marked to market. But what do I know? I’m no expert.

Who is Running Our World?

So far we are on pretty solid ground. Now let’s get into the realm of speculation.

First, remember that the internet began as a secure, closed information-sharing network of the U.S. Department of Defense and research institutions, called ARPANET. What they don’t tell you is that one of the goals of this network was to engage in weapons research at various universities across the country. That’s why the military created the network in the first place, in my opinion.

We also know that the Patent Office has confiscated thousands of inventions that the military and the intelligence community consider threats to “national security.” According to Wired (and many other sources),

Government Secrecy Orders on Patents Have Stifled More Than 5,000 Inventions. If the government thinks your patent-pending invention has national security implications, it can slap a secrecy order on it that prevents you from developing it. More than 5,300 such orders have been issued, with some of them in effect for decades.”

https://www.wired.com/2013/04/gov-secrecy-orders-on-patents/

If the Department of Defense thinks your invention is a threat to national security – which means, the established order – it can slap a Patent Secrecy Order on your invention. Which means you can’t commercialize it or even publicize it. Your invention just sits at the Patent Office.

According to Wired, “Tens of thousands of patent applications are manually examined each year under the Invention Secrecy Act and referred for a final decision to the Pentagon, National Security Agency, Department of Justice and, more recently, Department of Homeland Security.” Yeah. These outfits all belong to the military/intelligence complex.

But what happens to your invention after it gets sequestered? Well, as far as I can tell, it’s stolen, basically. An entire industry has been built around cutting-edge inventions that have been stolen from U.S. inventors. These inventions are monetized by venture capitalists (at places like the CIA and SVB Bank, the one that just failed and got bailed out.)

To see how the CIA monetizes patent information, let’s take a peek at In-Q-Tel, the CIA’s venture capital outfit. The name of the website is iqt.org. If you click on the “Portfolio” link (iqt.org/portfolio) you can see hundreds of cutting edge organizations sponsored by the CIA. This is just a screenshot of part of the first page:

These CIA-created/sponsored companies are creating high-tech startups using technology stolen from American inventors under the guise of national security. Some of this technology is being weaponized. But of course, it’s all in a good cause! Serving the interests of America’s elite millionaires and billionaires, and hidden cliques within the secret national security and intelligence community.

How many billions (or trillions) of dollars have CIA funded companies like this made over the years? Scroll through the portfolio section on the In-Q-Tel website and click on some of these companies. The CIA is engaging in cutting-edge tech in every imaginable field, funded by taxpayer money, and we have no say in what is being researched, or how that research will be applied to American society and the economy.

We can conclude by saying that innovation in technology is driven by a control paradigm, and it is managed by insiders in the military and in the intelligence community.

How do you like them apples?

But no worries, folks. Treasury Secretary Janet Yellen and President Joe Biden tell us that the banking system is “sound.” Like the avalanche of phony derivatives held by our banks, these people are divorced from reality. But remember folks. In Our DemocracyTM, ScienceTM and our “leaders” are working for the best interests of the people!

[1] https://world101.cfr.org/global-era-issues/cyberspace-and-cybersecurity/origins-internet